We believe in the transformative power of

GREEN ENTERPRISES

Our Vision

We believe in the power of green enterprises to achieve environmental and social impact, and with our approach we are creating a solid foundation for their growth.

Our approach is based on three components which support green enterprises, from preparing them to mobilise financing to funding facilitation to post-investment support. Each component is effective and impactful as a stand-alone component; combined they offer our unique approach to comprehensively facilitate access to finance for green enterprises.

We support green enterprises to develop the business and financial plans needed to access financing and scale their environmental and social impacts.

Six months of targeted support to review business models, prepare for growth, manage finances, create an investment project and plan and set up an impact monitoring system. Through group-workshops, we facilitate interactive sessions to refine business and financial plans, build solid growth plans, and develop key documents demanded by financiers. These include: Business Plans (including Impact Dashboard), Financial Plans (including financial statements, financial projections, and contingency plans) and Investment Plans (including description of investment project and finances).

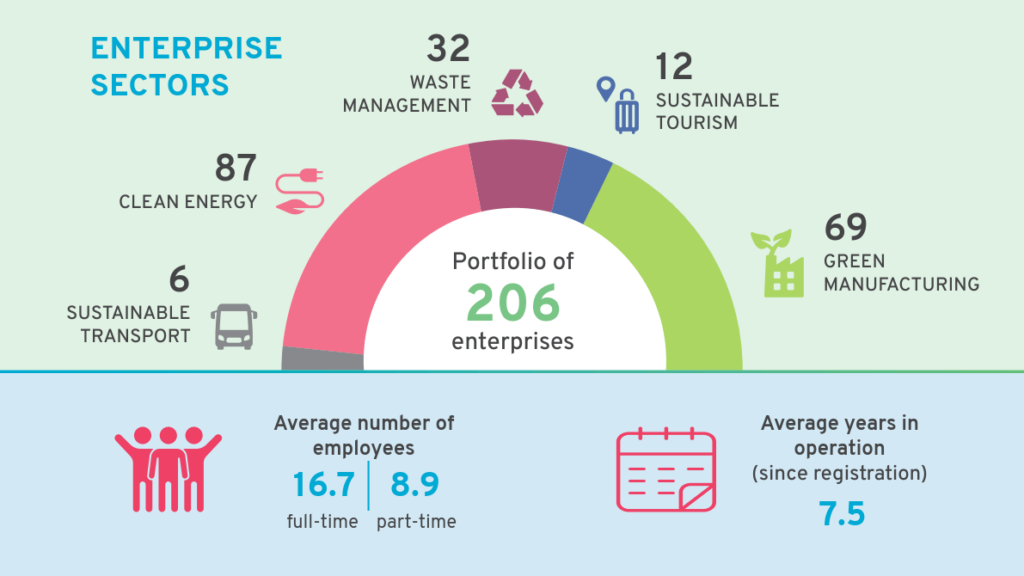

206 green enterprises participated in Catalyser Programme to date

Our modular Catalyser Programme is based on globally tested and proven toolkits and is delivered by experienced Business Advisors.

- Are you a green enterprise interested in participating in our Catalyser Programme?

- Are you a donor interested in a partnership?

- Are you a Business Advisor interested in becoming a certified trainer?

We facilitate tailored loans for green SMEs

In partnership with commercial banks, our Green SME Fund provides innovative blended finance to green SMEs.

We use grant funding to leverage private sector capital: Our partial repayment grants mobilise debt finance for green SMEs. With a leveraging factor of 3, our blended finance facility is highly effective: Every Euro of grant money mobilises at least two euros of private finance.

What is in for green SMEs? By lowering collateral requirements and the cost of finance through market-based mechanisms, accessibility and affordability of finance is significantly improved.

Working with a network of local and regional banks across Africa we bridge the missing middle financing gap to unlock the impact potential of green SMEs.

+ 6,7 Mio € of funding unlocked for green SMEs to date

Our ticket sizes range from 10,000 – 100,000 Euros. Terms and conditions such as interest rates, tenures, the availability of grace periods, fees and others depend on the respective partner bank.

Our current partner banks:

dfcu Bank, Equity Bank, Housing Finance Bank, I&M Bank, NCBA Bank, Opportunity Bank, PostBank

We support green enterprises to absorb recently acquired finance and to invest in growth.

Through group- and individual sessions, we support green enterprises to manage their investment project and business expansion, to successfully navigate organisational development and to monitor and scale their impacts. Our post-investment support de-risks investments and supports enterprises to yield returns, both in financial and in environmental and social terms. investment project and finances).

Topics to increase operational efficiency, enhance competitiveness and scale market reach include leadership & change management, growth partnerships, innovation, digitalisation, next-level finance and strategic marketing.

XXX green enterprises participated in Accelerator Programme to date

Are you a green enterprise interested in participating in our Accelerator Programme?

Are you a donor interested in a partnership

Are you a Business Advisor interested in becoming a certified trainer?

Green enterprises we support

The future is green, and small-and medium-sized enterprises are leading the way. UGEFA-supported businesses are innovating products and services that meet current demands while preserving valuable natural resources for future generations.

The UGEFA programme supports enterprises from green manufacturing (including agro-processing), clean energy, waste management, sustainable tourism and sustainable transport sectors. Meet some UGEFA-supported enterprises here.

Join us in championing a sustainable future by exploring the pioneering efforts of these enterprises today!

How does it work?

1. Registration & Application

We can only accept applications submitted during our Call for Application periods. The Application cycle is closed at the moment, but you can register interest.

2. Catalyser Support & Loan Application

Hands-on interactive workshops, where enterprises work with peers on key topics for financial readiness and growth.

3. Accelerator Support

Our Accelerator Programme will provide growth and investment support to successfully scale your enterprise.