2023 marks an event- and impactful year for the Uganda Green Enterprise Finance Accelerator. “Green entrepreneurship” is gaining momentum in Uganda. Several enterprise support organisations have started to focus specifically on green enterprises; at the same time, Uganda’s financial sector has started to prepare to increase the level of financial flows into investments that provide environmental benefits. The Ministry of Finance, Planning and Economic Development has successfully established a Climate Finance Unit, with the objective to spearhead the mobilization of climate finance to support the country to mitigate and adapt to climate change; the banking sector continues to strategically anchor green sector financing within their operations. The demand of the financial sector to identify bankable green enterprises will significantly increase – and green enterprises, which have started early to develop sustainable business models and green investment projects will be at the forefront to access green finance to accelerate their growth and to scale their impacts.

UGEFA is spearheading this transformation towards a green, socially-inclusive economy, united role models and pioneers of Uganda’s SME and banking sector and hence celebrates important milestones that have been achieved in 2023.

Christine Meyer, UGEFA Programme Lead

Access to finance is one of the key challenges faced by not only green SMEs in Uganda. Key requirements of financial institutions include the availability of a comprehensive and solid business plan, financial statements, a sound financial management system, as well as convincing investment plans. These are sometimes daunting tasks to manage while running a business.

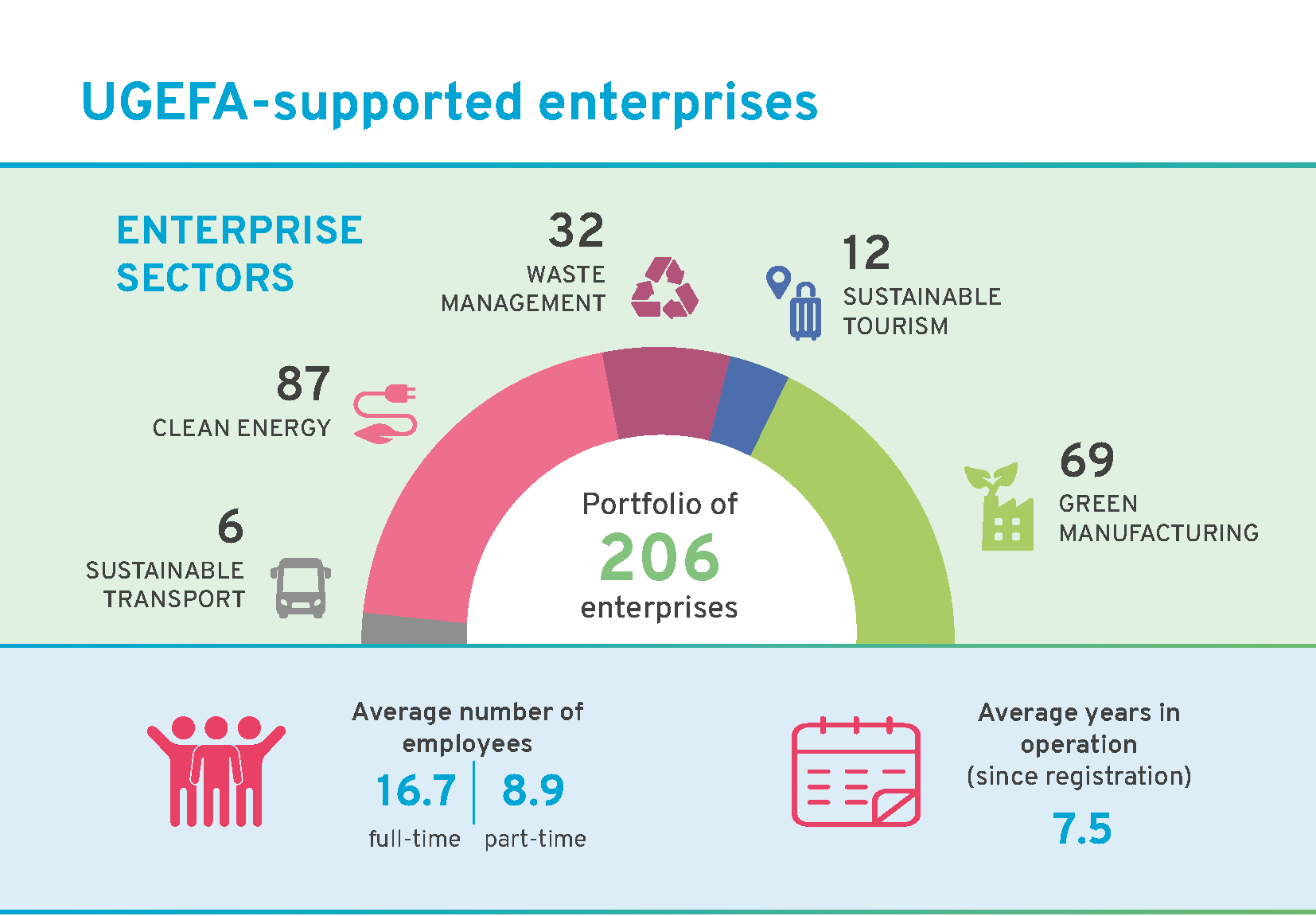

The UGEFA Catalyser Programme supports green enterprises to refine their business and financial plans, build solid growth plans and develop key documentation to support funding applications. Each enterprise benefits from 12 in-person, group-based workshop days over the course of three to six months, delivered by UGFA’s experienced business advisors. The 6th – for the moment last – cohort of the Catalyser graduated in November. To date, 206 green enterprises graduated UGEFA’s Catalyser Programme, ready to apply for funding to scale their operations and impacts.

Find out more in the UGEFA SME Portfolio.

130 green enterprises have been introduced to partner financial institutions – with success: More than 12 billion UGX of green, blended finance has been unlocked and deployed to date. In partnership with commercial banks, UGEFA has set up an innovative funding facilitation mechanism, which uses grant funding to leverage private sector capital. So far, 45 green enterprises benefitted from the facility. The average ticket size disbursed amounted 665,000 UGX, which confirms that there is a great need for “missing middle finance” – ticket sizes which are too big for microfinance institutions, but too small for traditional bank lending, equity funds and others.

Uganda’s banking sector is increasingly engaging in green sector financing. Interest in green and climate finance is gaining momentum. UGEFA is proud that three further partnerships with Ugandan banks have been announced in 2023. Stanbic Bank, dfcu bank and NCBA bank joined a community of financial institutions spearheading the commitment to channel financial flows towards environmentally sustainable initiatives.

UGEFA’s year 2023 culminated in November: UGEFA’s flagship event, the Green Finance Dialogue Forum took place in Kampala. More than 120 representatives of government and the financial sector, international organisations, green SMEs and business advisors as well as enterprise support organisations attended to discuss challenges and co-create tangible solutions to scale green investments in Uganda. A green enterprise exhibition with 30 booths showcased a variety of green business models that have proven to be successful to bring sustainable products and services to the market. Agenda-setting panel discussions engaged distinguished representatives of the Ministry of Finance, Planning and Economic Development, Bank of Uganda, Equity Bank Uganda, Stanbic Bank Uganda, the Delegation of the European Union to Uganda, British High Commission Uganda and aBi Finance Ltd. to explore the climate finance gap and innovative green finance instruments and replication opportunities to tackle existing challenges. Interactive Practitioner Labs engaged participants to work on practical solutions and partnership to solve key questions on the future of green SME finance.

Overall, it has been an eventful year. UGEFA has reached impact at scale – with the help the Delegation of the European Union to Uganda as UGEFA’s funder, a community of excellent Business Advisors, our partner banks, UGEFA’s proven toolkits and methodologies, and of course the 206 committed green enterprises investing time, resources and efforts to drive forward a green and socially-inclusive Ugandan economy.

Allen Babirye, Natures Love Packaging Ltd

Allen Babirye from Natures Love Packaging Ltd participated in the latest Catalyser cohort. She shares that “during the Catalyser program, I networked with the fellow entrepreneurs, obtained more entrepreneurial skills, especially in market analysis and risk management. As a team, we identified the essential business documents for securing funding through the program.” With her enterprise, she enables businesses to reduce their carbon foot print by providing them eco-friendly packages.

As her highlight in 2023, she reports: “We have established more strategic partners like UGEFA and supported over 30 businesses to reduce their carbon footprint. We are committed to fostering a green economy as we support more businesses while expanding our impact to women and youths.”

Claire Kagga, Renewable Energy Business Incubator, UGEFA Business Advisor

Claire Kagga from the Renewable Energy Business Incubator (REBi) has implemented 4 Catalyser cohorts with 38 enterprises in total. After completing her fourth cohort in November 2023, she has shared some her insights from this year:

“The cohort that we facilitated this year was very active. They are all looking forward to being introduced to the banks to commence their loan application process after uploading their final documents soon. There has been increased trust in and appreciation of the UGEFA program on the side of the enterprises. Many that were skeptical in the earlier years of the program have reached out to us this year to apply for loans.”

In terms of her personal highlight, she reports: “Having 7 successful loan applications from the entrepreneurs of our previous Catalyser cohorts was a key achievement in 2023. More entrepreneurs are updating us that they are finalizing their negotiations with the banks and expect to receive loan financing before the end of December 2023. The announcement of 3 new partner banks at the Green Finance Dialogue Forum is a crucial step for the entrepreneurs.”

Fred Kato, Segment Head SME at Equity Bank Uganda Ltd

Equity Bank is one of UGEFA first partner banks, the partnership was established in 2021 and UGEFA and Equity Bank are looking back at 3 years of collaboration.

“We are truly grateful for the partnership with UGEFA, it has greatly supported Equity Bank in the achievement of its purpose of transforming lives and giving dignity to the people of Uganda especially through UGEFA Catalyser program. In the year 2023 a number of customers in green business have been trained and recommended to the Bank for financing by UGEFA especially customers in the field of Renewable Energy, Energy efficiency systems and climate smart agroprocessing.

With the support of UGEFA especially in lead generation and staff & customer training, the bank has achieved several milestones in 2023 including implementation of the New Equi-Green product in all branches across the country, obtained ESG Champion Award 2023 by Private Sector Foundation and installation of improved cook stoves in different regions using some of the customers recommended by UGEFA. The Bank has further put in place a risk profiling model that limits financing customers that are in businesses affecting the Environment.

We are looking forward to categorising all our existing customers into Green and Non-Green customers in the year 2024 with the support of UGEFA and other partners and approve special terms for all climate finance products at Equity Bank. As a subsidiary of Equity group we shall focus on a multi-prolonged holistic strategy to achieve the socio-economic transformation of the people of Africa while focusing on sustainability.”

At UGEFA, we look forward to an even more impactful 2024. If you wish to collaborate with UGEFA, get in touch at: info@ugefa.eu