13 APRIL 2022 | KAMPALA

The second edition of UGEFA’s Green Finance Academy took place from 29th – 31th March 2022 in Kampala. The Green Finance Academy, a partnership between the Uganda Green Enterprise Finance Accelerator and SEED, collaborates with the banking sector to innovate financial instruments spurring climate action and a transition to a green economy in Uganda.

A budget of 5.5 billion USD is needed to implement Uganda’s Nationally Determined Contributions (NDCs)[1], the country’s action plan to reduce greenhouse gas emissions and adapt to the adverse effects of climate change.

The banking sector can play a catalytic role to close this gap, by unlocking capital for market-based green projects.

The eleven Ugandan banks, that joined the Green Finance Academy, have demonstrated their innovation potential to not only engage in climate action to manage physical and transition risks arising from climate change, but also to leverage opportunities by capitalizing on new markets. Small and medium-sized enterprises (SMEs), the backbone of Uganda’s economy, through their green business models, provide market-based solutions, which are centred around revenue generating activities that help to recover project costs and generate a return on investment.

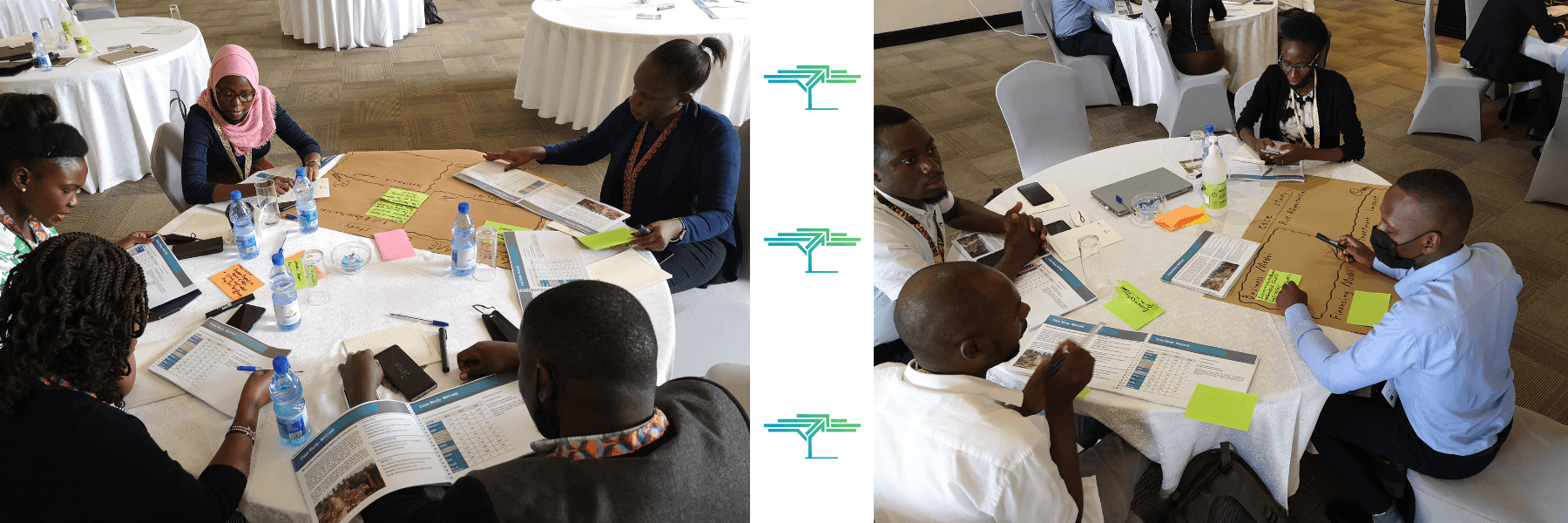

Six banks joined the Innovation Lab, one of the modules of the Green Finance Academy, from 29 – 31 March 2022 to collaboratively design solutions to tackle common challenges in green SME financing, such as high transaction costs, complexity of green technologies, and shallow pipelines for green SMEs.

Representatives from Stanbic Bank, FINCA Uganda, United Bank for Africa, NCBA, Centenary Bank and Uganda Development Bank explored opportunities to expand their products and services in line with green banking opportunities in Uganda. A green finance expert exchange on 31 March 2022 engaged further actors from financial institutions, foundations, government representatives, intermediaries and donors to jointly discuss innovative green finance instruments and explore opportunities for collaboration.

Solutions developed include a digital financial product for sustainable smallholder farmers and cooperatives, a tailored loan product for solar-irrigation, eco-financing solutions for clean and off-grid energy and solutions, a green mortgage instrument. These instruments will be further refined during the coming weeks.

Are you interested in the Green Finance Academy or would you like to receive further information on the green finance instruments that were developed as part of the Innovation Lab?

Please contact the UGEFA team at: info@ugefa.eu

The Academy is funded by the Delegation of the European Union to Uganda under the Uganda Green Enterprise Finance Accelerator programme and the German Federal Ministry for the Environment, Nature Conservation and Nuclear Safety within the SEED programme and will focus on creating opportunities for Ugandan banks, who will benefit from access to case studies and global good practices of green finance and expert training – thus, laying the basis for co-creating the next generation of financial instruments for green finance in Uganda.

[1] https://www.acode-u.org/uploadedFiles/PBP51.pdf