DECEMBER 2021 – MARCH 2022 | KAMPALA

The Green Finance Academy Trainings and Innovation Lab – a collaborative partnership between the Uganda Green Enterprise Finance Accelerator (UGEFA), Uganda Bankers’ Association (UBA), SEED Practitioner Labs Climate Finance and GO4SDGs – offers an exclusive opportunity to commercial banks in Uganda with key ecosystem actors to strengthen the financial sector’s capacity to successfully finance green small- and medium-sized enterprises (SMEs) and environmental-related projects in Uganda.

The Academy is funded by the European Union and the German Federal Ministry for Environment, Nature Conservation and Nuclear Safety.

The Academy supports the commitments of the Uganda Green Growth Development Strategy and its focus on five investment areas of agriculture, natural capital management, green cities, transport, and energy. To achieve core targets for green growth and job creation, financing needs to be mobilised – with a target of US$1.8 billion per year. This funding is expected to be contributed from multiple sources, with a strong role to be played by the financial sector in Uganda. In expanding these financial commitments, the central role of SMEs as economic players in Uganda – providing employment to over 2.5 million people and contributing around 90% of private sector production – must be supported.

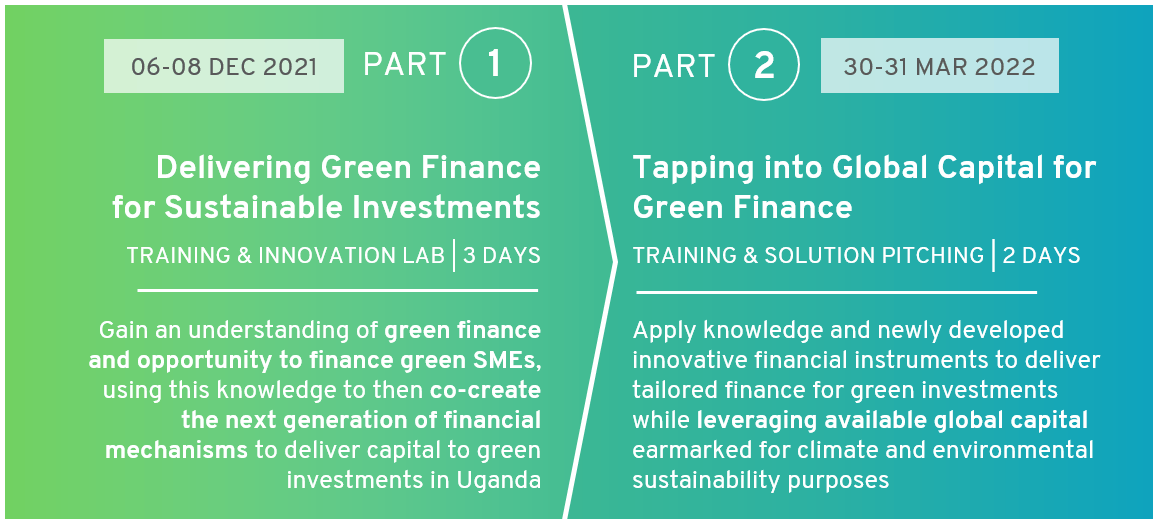

The hands-on trainings support financiers to gain a thorough understanding and develop the groundwork to deliver tailored financing for green investments, including for SMEs across sectors, while tapping into growing international capital earmarked for climate and broader green finance purposes. Participants will benefit from access to case studies and global good practices of green finance – thus, laying the basis for co-creating the next generation of financial instruments for green finance in Uganda during the innovation lab – building on the global success of the SEED Practitioner Labs Climate Finance innovation lab programme.

Highlights from Part 1 (06-08 December 2021)

From 06-08 December, representatives from seven different Ugandan banks – including Bank of Africa, Cairo Bank, Equity Bank, Finca Ltd, Housing Finance Bank, PostBank Uganda Limited, and United Bank for Africa – explored opportunities to expand their products, services and policies in line with green banking opportunities in Uganda.

On Day 1, the training with innovation lab was kicked-off with welcoming remarks from Nadia Cannata, Head of Sustainable Development, European Union Delegation to the Republic of Uganda.

As a collaborative initiative, core partners then introduced the Academy’s objectives and hands-on methodology:

- Rainer Agster, Uganda Green Enterprise Finance Accelerator / adelphi Research gGmbH (Executive Board Member)

- Myrae Namuyimba, Uganda Bankers’ Association (Consultant)

- Frank Turyatunga, Global Opportunities for Sustainable Development Goals (GO4SDGs) / United Nations Environment Programme (Deputy Regional Director, UNEP Regional Office for Africa)

UGEFA-supported businesses from across sectors joined the Academy in the afternoon to share their journeys, focusing on what about their products, services and processes make them “green” (or environmentally sustainable and resilient):

- HS Green Energy Engineering Company (Clean Energy)

- MICE Uganda Ltd (Sustainable Tourism)

- KaCyber Security Technologies Ltd (Sustainable Transport)

- Africa Spices Uganda Limited (Green Manufacturing)

- Bin It Services (Waste Management)

Building on newly gained knowledge of green finance and green SME business models, on Day 2, participants learned from global good practices in green finance instruments to then develop their own Green Finance Instruments designed to effectively deliver growing green finance capital flows to green SMEs. Participating bank representatives laid the groundwork for three new Green Finance Instruments that leverage investment performance evidence of vetted green technologies, existing networks of ecosystem actors (notably industry associations, cooperatives, and VSLAs/SACCOs) to de-risk investment in and deliver much needed capital to green investments by SMEs.

The third day welcomed green finance fund and network actors to share further insights into opportunities for commercial banks to engage in green banking activities. Experts joining a panel discussion included:

- Anna Nikolaeva-Schniepper, Senior Portfolio Coordinator for Rural Development & Financial Sector, KfW Development Bank

- Reginal Max, Senior Advisor in Infrastructure and PPP, Trade and Development Bank (TDB)

- Reuben Wambui, Africa Regional Coordinator, United Nations Environment Programme Finance Initiative (UNEP FI)

These expert insights were applied as participants explored opportunities to align their bank’s policies with opportunities for green banking through product and service design and delivery.

Participating Green Finance Academy bank representatives will continue to refine their Green Finance Instruments while exploring opportunities for further green banking policy integration with the expert guidance of the UGEFA Team in advance of Part 2 of the Academy in March.

Interested in collaborating? Please contact the UGEFA team via email at: info@ugefa.eu

Further details about the Green Finance Academy available here.

The Academy is funded by the Delegation of the European Union to Uganda under the Uganda Green Enterprise Finance Accelerator programme and the German Federal Ministry for the Environment, Nature Conservation and Nuclear Safety within the SEED programme and will focus on creating opportunities for UBA Member Banks, who will benefit from access to case studies and global good practices of green finance and expert training – thus, laying the basis for co-creating the next generation of financial instruments for green finance in Uganda.